Virtual Visa Cards for your business

Pay online for subscriptions, hosting websites & email, software licenses, and more using virtual Visa cards

Free trial available

Safe online payments

Using your bank-issued cards or personal cards to make online payments puts your funds at risk from fraud and surprise charges. Single-use virtual cards from Xente eliminate this risk

Control over your company money

Set policy and control individual spending. You can limit the amount spent, the merchant category that can spent at and even the time of spending

Real-time payment visibility

Access all your online payments in real time from one dashboard to keep track of all your online spending.

Questions & Answers

Answers to your frequently asked questions.

1. What is are Xente Visa virtual card ?

A Xente Visa virtual card is a digital card (as opposed to a physical card), complete with unique numbers that you access via a secure link. Use it to make online payments anywhere that Visa is accepted.

2. What are the benefits of virtual Visa cards for business ?

Virtual cards are more secure, prevent vendor fraud, limit your risk with subscriptions, and help control spending.

3. When should businesses consider using Visa virtual cards

Businesses should use virtual cards when shopping online, making one-time purchases, or paying for software subscriptions, such as Microsoft and Uber.

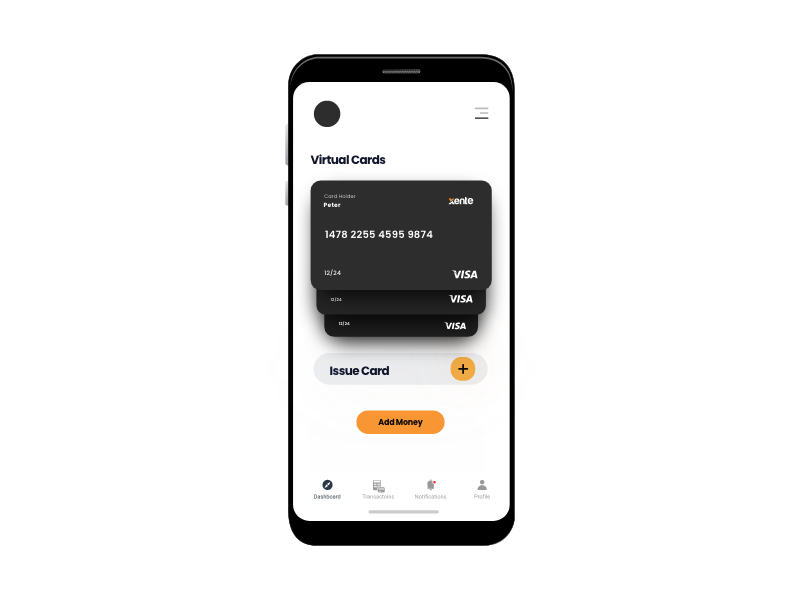

4. How do Xente Visa virtual cards for business work ?

1. Sign up for a Xente business account

2. Create a Xente Visa virtual card

3. Assign to your team member - they receive an email with a link to the virtual card

4. Fund the virtual card from your Xente business wallet

5. Pay online anywhere Visa is accepted

5. Can I use virtual cards in-store ?

Virtual cards are designed for online payments.

Have more questions? Visit our help center